Categories

How to Receive a Lower Mortgage Rate on a New Harris Doyle Home

Mortgage rates have many homebuyers feeling hesitant about moving forward with a home purchase. We understand it can be stressful, and we want to give you peace of mind when it comes to financing a Harris Doyle Home. Harris Doyle’s goal is to make buying a new home a smooth and painless process – even when it comes to financing. Our preferred lender, Silverton Mortgage, is a recognized leader in the mortgage industry and our working through our partnership can save you time, effort (and possibly money) during the home-buying process.

To ease the burden of stressful mortgage rates, Harris Doyle is offering two mortgage incentives on select homes when you finance through Silverton. In the below paragraphs we will discuss each incentive and how you can take advantage of lowering your mortgage rate with Harris Doyle Homes.

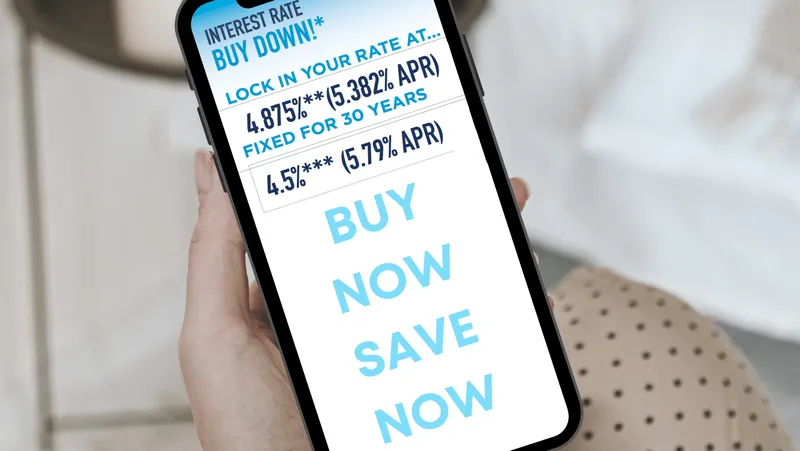

How to Receive a Rate Buy Down on Select Harris Doyle Homes

When you use Silverton Mortgage to purchase a Harris Doyle Quick Move Home (closes in 60 days or less), Harris Doyle will pay to lower and lock in your rate at 4.875% (conventional at 5.382% APR) for 30 years or 4.5% (5.79% APR) for FHA loans. This promotion is only available in certain communities and for selected lots and expires October 31, 2022.

In addition to the rate buydown, Harris Doyle will contribute up to $2,500 toward you closing cost, and cover the coast of locking in your interest rate for up to 60 days.

Restrictions do apply, so be sure to click here to see full description of details on the incentive flyer.

How to Receive a Guaranteed Extended Rate Lock on a Harris Doyle Home

Harris Doyle will pay to lock in your rate for up to 270 days, up to a $7,500 value, when you use Silverton Mortgage to finance a Harris Doyle home. This promotion is only available in certain communities and for selected lots and expires October 31, 2022.

In addition to the rate buydown, Harris Doyle will contribute up to $2,500 toward you closing cost. Click here to see full description of details on the incentive flyer or reach out to our Online Sales Consultant, Kristie Cotter via email at kristie.cotter@harrisdoyle or 205.307.5366.

How Much Can a Mortgage Rate Buydown Really Save You?

Many homebuyers may not realize the savings even a 1-point difference in interest stand to save you on a 30-year mortgage. As you might imagine, it’s a common question that many aspiring property owners are asking themselves with mortgage rates fluctuating.

A single percentage point on mortgage rates may seem like it would produce only a small difference in your monthly payment, but remember…over time, this single point can add up to a small fortune. You may be surprised to learn that the difference that a 1% decrease in mortgage rates could add up to tens of thousands of dollars in savings over the life of a 30-year loan term.

To see just how much our rate buydown could save you on your new home, we encourage to reach out to Harris Doyle’s personal Silverton Mortgage expert – Stephanie Gant, for a free confidential review of your financial situation.

Who is Silverton Mortgage?

Founded in 1998, Silverton Mortgage has grown from a one-person operation to a top residential mortgage lender. Much like Harris Doyle, they credit their years of success to the relationship with clients and the hard work of their diligent team members.

Our partnership means that Silverton Mortgage has a dedicated team of loan originators that specialize in Harris Doyle home buyers, making them experts in new-home construction lending, the different types of loans available and our particular processes. Their team, with a combined 75 years’ experience in the industry, demonstrates a true commitment to helping homebuyers every step of the way. Whether they’re answering questions, explaining loan steps, providing valuable advice or handling the nitty-gritty details of your future mortgage, their end goal will always be to provide you with the best experience possible.

Both Silverton Mortgage and Harris Doyle Homes are part of the Berkshire Hathaway family of companies, so we are working toward the same end goal of helping you achieve your homeownership dreams while keeping customer satisfaction top-of-mind.

How to Get Connected and Prequalified with Silverton Mortgage

Ready to start the process of purchasing a Harris Doyle home with the help of Silverton Mortgage? Check out some need-to-know information about financing your new home or start the pre-approval process with Silverton today. You can also contact our team to learn more about the availability of our guaranteed extended rate lock program as well as Harris Doyle Homes upcoming communities in Birmingham, Auburn and the Florida Gulf Coast.